Written by Kevin O’Neill

The newest generation of industrial manufacturing is here. Shaped by the confluence of the physical and digital world, it’s considered by many to be the Fourth Industrial Revolution. To thrive amid today’s exponential change, we highlight how manufacturers can define a road map to growth and the leaders that will drive it.

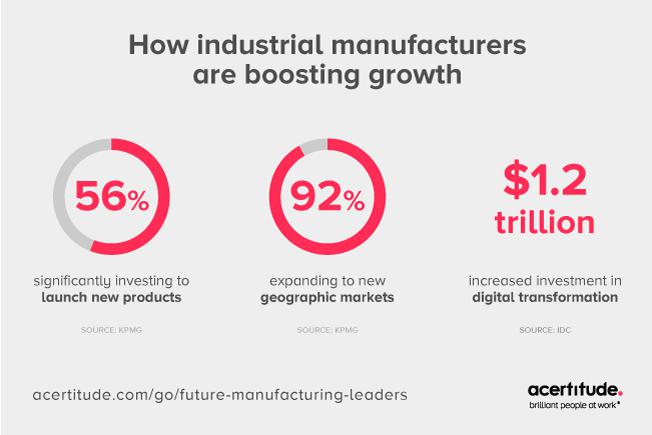

Growth remains a high priority for industrial manufacturers (74%) over the next two years. Firms’ business development will focus on three primary strategies:

- Evolve products and services,

- Expand to new geographic markets, and

- Digital transformation.

Evolve products and services

Today’s competitive landscape challenges manufacturing leaders to rev up their product and service offerings. The velocity and variability of traditional product development life cycles are heightened — be it improving existing, developing new, or exiting outdated product strategies. Simply put, disrupt or be disrupted.

Manufacturers are tackling this challenge head-on. At the enterprise level, they are growing by reinventing product and service models and investing in R&D.

Manufacturers are building new revenue streams based on annuity accounts by shifting from shorter-term product sales to longer-term service contracts. With greater insight into the customer base through integrated operations and technology, manufacturers are also adding value by customizing solutions for customers’ challenges. They are tightening technology for seamless operations and maintenance to manage solutions across the company and customer technology ecosystem.

Similarly, small and medium-sized manufacturers benefit from product innovation.

“One of our furniture-manufacturing clients is cleverly incorporating continuous product innovation into their product development pipeline,” shares Tom Dougherty, partner. “The company leverages real-time customer feedback to make product enhancements and refresh product line categories every four to six months. This enables them to remain relevant and improve product margins.”

Expand to new geographies

As always, outside forces impact the industry. Global political and economic uncertainty, amplified by Brexit and the U.S. presidential election, had leaders hesitant to make investments that could be impacted by changes in the flow of goods across borders.

However, businesses are becoming more optimistic. The World Bank forecasts that “global economic growth will strengthen … as a pickup in manufacturing and trade, rising market confidence, and stabilizing commodity prices allow growth.”

This is good news for global manufacturers who seek to reduce costs or capture new customers by entering new geographies. As many as 87% of manufacturers took steps to enter new markets over the past two years or plan to do so over the next two years (92%).2

Founder and Managing Partner Kevin O’Neill says, “We’re seeing most clients adopt one of these growth strategies. For example, geographic expansion was the underlying driver for our CEO search for Enbi, a global manufacturer for the office equipment industry. They needed a CEO to accelerate growth, expand market share, and drive operational synergies globally. This translated into hiring a candidate who was not only an accomplished GM but a highly sought-after sales, marketing, and services executive.”

On the other hand, small and medium-sized manufacturers face challenges — including responding to increasing demand while battling talent and skills gaps. But growth is not elusive. One tactic? SMEs are turning to exporting — 65% to increase sales and profits and 21% to meet customer needs.

Digital transformation

Beyond the hype, digital transformation creates meaningful opportunities for organizations. It drives changes to operating models, the development of smart partnerships, targeted investment strategies, and assertive hiring practices.

At the operational level, manufacturers invest in digital to unleash the power of information. This increases visibility across the supply chain, improves efficiency, reduces costs, improves customer experience, and integrates customer operations. The amazing advancements in 3-D printing, artificial intelligence and machine learning, robotics, the internet of things, and big data and analytics are also transforming every step in the value chain.

Advantages gained through digital transformation initiatives impact the workforce, leadership, and marketplace interactions. For example, global manufacturers can better source and manage globally dispersed workforces 24 x 7 x 365 through connectivity and business process technologies. SME manufacturers can leverage marketing automation and customer relationship management technology to improve marketing reach and customer experiences — often without breaking the bank. And by using 3-D printing technologies, smaller manufacturers can get products to market using less time and resources.

How do these strategies impact leadership needs?

Manufacturers must dive deeper to identify board members, CEOs, and executives who can unleash their organizations’ potential.

New talent filter

As the industry evolves, so do talent needs. Manufacturers are targeting a new profile to fill executive team roles and move their business forward.

Historically, manufacturers recruited generalists. “Looking back 15 to 20 years ago, manufacturers pioneered strategies to grow and promote executives from within,” notes Dougherty. “Companies often recruited talent directly from higher-ed institutions that reflected their core values, then trained them in functional leadership. The goal and the result were well-rounded executives — generalists.”

However, as the competitive landscape shifted — driven largely by technology advancements and an interconnected global economy — manufacturers changed their recruiting strategies to match the pace of change. Today, manufacturing firms seek specialists who can immediately make an impact.

“Leadership needs are specific and briskly changing, requiring talent who’ve led organizations through certain life cycles and initiatives or demonstrated deep functional leadership,” adds Dougherty. “They bring professional spikes and skills corresponding with our clients’ situation. This is especially true for private equity–backed portfolio companies where needs are based on time-sensitive performance measures and the exit strategy.”

Redefining roles and skills

Rapidly advancing technology, globalization, and geographic expansion are redefining the roles and skills needed in the C-suite. Sought-after executives bring expertise from the latest management toolbox, including in data analytics, cybersecurity, data quality, compliance, and technology transformation.

“One of our global, private equity–sponsored manufacturing clients exemplifies how leadership needs are evolving in this space,” says O’Neill. “As we listened to the CEO, it became clear that we needed to uncover candidates with both foundational and cutting-edge skill sets — from the chief operating officer to the chief financial officer, general manager, and business development leadership. While the firm’s business model and products are straightforward, its supply chain and just-in-time production made cyber security a critical requirement. You would not have seen that even three years ago.”

As manufacturers look to bring in new executives, they must take the time to detail where the business is going and how they will get there. Only once that is clear should they define the qualifications, competencies, and skills required of their next round of leaders.

“The clearer the business road map, the more successful the hiring process and the placement,” adds O’Neill. “By diving deeper into the levers that will make your business shine, identifying people who will shine also becomes more achievable.”

References

1 & 3.) https://home.kpmg.com/xx/en/ho...

2.) http://www.worldbank.org/en/ne...

4.) http://www.nsba.biz/wp-content...

Never miss insights

Stay in the know with our thought leadership